Why don’t more companies measure their return on R&D investment? Every CFO is expected to know the return on a company’s financial investments. Yet they rarely do the same for what is often their biggest investment – developing new products and services.

I think there are three reasons. One is organizational: whose responsibility is it? The CFO? The VP of Engineering? The VP of Product Management? Selecting a portfolio of new products and services to develop is a collaborative effort, but it’s often unclear who owns the overall success of that portfolio. I find that in companies with a Program Management Office (PMO), they often take measurement responsibilities. Otherwise, it tends to fall through the cracks.

Another reason is that measuring return on R&D investment is not easy. There’s no accepted formula or definition. Collecting the data can be hard (but it’s getting easier). You might have to make some assumptions along the way. It’s easier for hardware companies selling discrete widgets, but for software companies, especially those using a subscription model, it can be downright hard.

Finally, measuring the return on R&D investment requires a long time horizon. Companies tend to closely track schedule and cost for R&D projects, which are easy to collect in real time. Calculating the return on investment requires looking back some time after the product or service has been released (more on that later). In the meantime, management attention has moved on to other things. So this activity needs to become part of the regular business review cycle, or it just won’t happen.

Why does this matter? I believe that many companies are underperforming in their return on R&D investment, and by actively reviewing this metric, they might determine to make better product and service investment decisions. I can’t think of another part of the enterprise that consumes as much capital and is allowed to run so open loop.

Product Development Lifecycle Economics

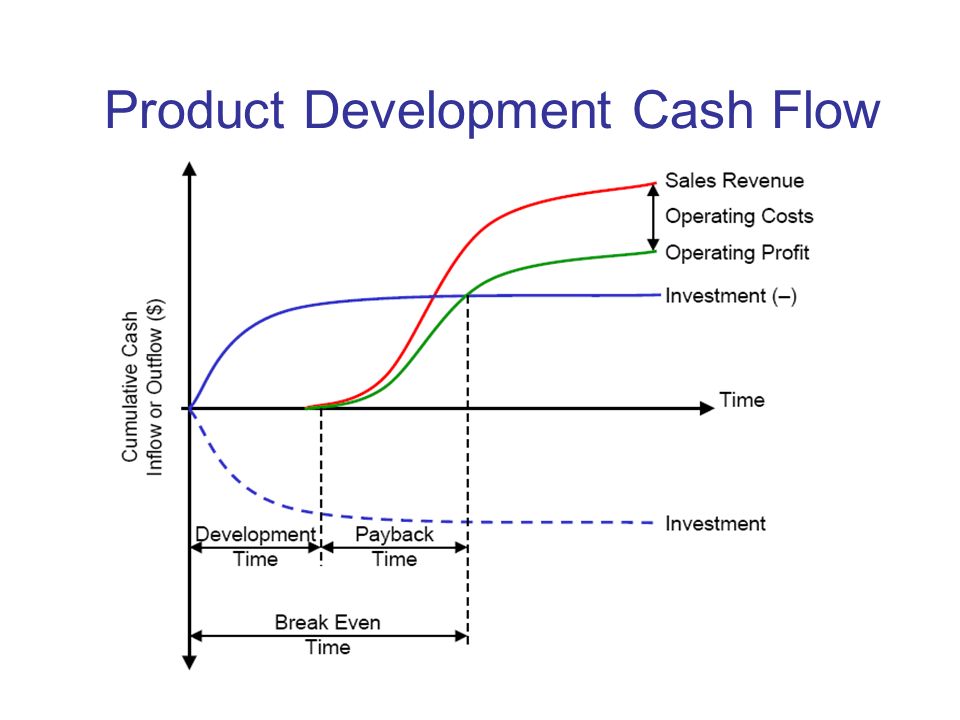

The first thing you need to understand to calculate the return on R&D investment is this chart:

When you develop a new product or service, you spend money, sometimes a lot of money. It has been estimated that Boeing’s 787 aircraft cost more than $30 billion to develop! Most of us are not in that kind of high risk business. But it’s not unusual for a project to consume a few million dollars, even for software.

How long it takes you to recoup that investment and start turning a profit is a key measurement of R&D effectiveness called Break Even Time (BET). Hewlett-Packard was the first company to start tracking this metric in the 1980s. BET isn’t a detailed return on investment calculation, but as a shorthand gauge of success, it’s quite good. In our next few blogs, we will look at some examples.